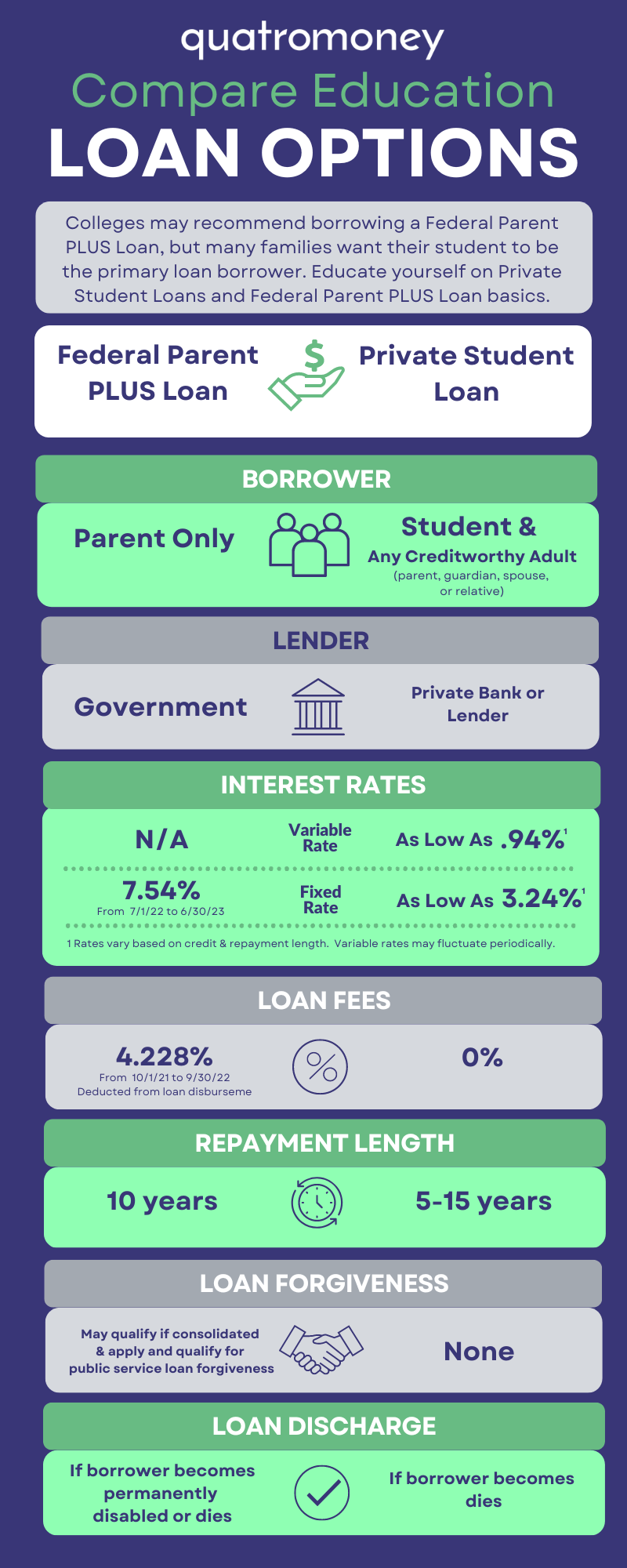

Easily Compare the 2 Most Common Family Loans to Pay for College

Tons of families struggle to decide the best loan to finance the undergraduate tuition bill after they have exhausted scholarships, grants, savings, cash from income, and Federal Student Direct Loan. The two most common loans to pay for college costs that fill this gap are the Federal Parent PLUS Loan and the Private Student Loan .

There are some striking differences between the two loans like interest rate structures, fees (or lack of fees), the lender, and the primary borrower. Depending on family’s credit strength, one option may be more affordable than the other - - in other words one loan may have less financing costs over the life of the loan. Educate your family on these two loans that pay for college costs to decide on the best financing option to meet your needs.

Federal Parent PLUS Loan vs. Private Student Loan Comparison

Colleen Krumwiede

Co-Founder & Chief Marketing Officer

Colleen MacDonald Krumwiede is a financial aid and paying for college expert with over a decade of financial aid experience at Stanford GSB, Caltech, and Pomona College and another decade at educational finance and technology companies servicing higher education. She guides go-to-market strategy and product development at Quatromoney to transform the way families afford college.

Share

Recent Posts

Quatromoney

Quatromoney

276 Bridge Street

Springfield, MA 01103

Stay Informed with

The Good Math Blog

You need a helping hand with your project?

Thank you for subscribing to the Good Math Blog. We will send periodic emails with the latest posts.

With appreciation,

The Team at Quatromoney

Oops, there was an error sending your message.

Please try again later.

The Team at Quatromoney

All Rights Reserved | Quatromoney