Federal Direct Loan Rates Up About 1%

Economic conditions are changing which is going to be reflected in the 2021-22 Federal Direct Loan interest rates. If you are borrowing a Federal Direct Loan next academic year, the fixed interest rate loan will rise almost 1%.

How are the interest rates set?

Federal Direct Loan interest rates are set annually based on the 10-year Treasury note. The May 10-year Treasury note auction triggers that annual interest rate adjustment of the Federal Direct Loans. The formula used by the Congressional Budget Office (CBO) sets the rate annually starting July 1st and June 30. For undergraduate students, the Federal Direct Student Loans are based on the May 10-year Treasury rate plus 2.05%, capped at 8.25%. Federal Direct Parent PLUS loans use the May 10-year Treasury rate plus 4.60%, capped at 10.50%.

Since last week’s hotter-than-expected inflation drove up Federal Direct Loan interest rates, next year’s borrowers will face higher interest rates. On May 12, 2021, the 10-year Treasury note auction was at 1.684%.

What are next year’s rates?

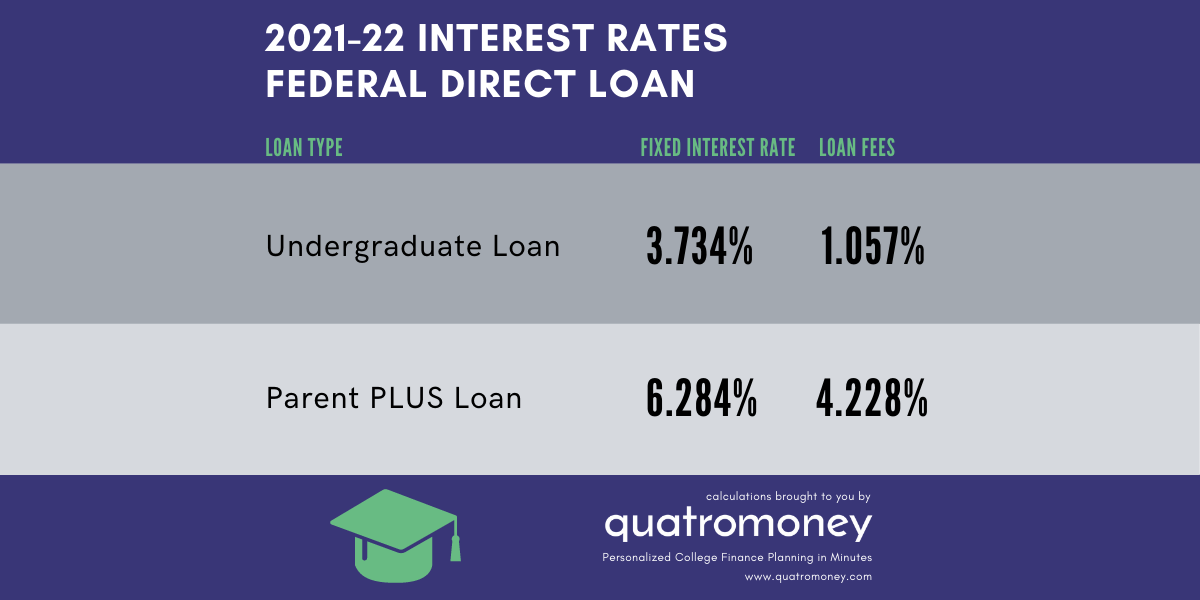

Undergraduate Federal Direct Student Loan borrowers have a 3.734% fixed interest rate for next year’s loan, up from 2.75%. Parents of undergraduates can borrow at 6.284% interest rate, up from 5.3% in the Federal Parent PLUS Loan Program.

Every Federal Direct Loan has a loan fee. Based on the US Budget Control Act of 2011’s automatic deficit reductions, loan fees are set annually when the new federal fiscal year begins on October 1st. Currently, undergraduate Federal Direct Student Loan borrowers are charged 1.057% in loan fees which is deducted from each loan disbursement. Parent borrowers in the Federal Parent PLUS Loan are charged 4.228%. This means that the undergraduate borrowers will net $4,947.15 after loan fees for a $5,000 loan, whereas parent borrowers would net $4,788.60.

How much more will it cost versus last year?

Since parent borrowers often borrow the most annually, let’s look at the difference between how much it cost them last year vs next year for the same loan amount. For this example, we will assume the parent started repayment immediately on their Federal Direct Parent PLUS Loan while their kid is enrolled in a bachelor’s degree. If they borrowed $10,000 last year and repaid using a standard repayment plan, their total payments would total $12,905. Next year, if they borrow the same $10,000, it will cost them $589 more over the life of the loan.

Pro Tip: Know the basics about Federal Direct Student Loans and Federal Parent PLUS Loans before you borrow. Here are some quick additional posts to learn more:

- 7 Things You Should Know About Federal Direct Student Loans

- 6 Federal Parent PLUS Loan Basics You Need to Know

- Student Loans: Borrow What You Need

- What is Considered Adverse Credit for a Federal Parent PLUS Loan?

Colleen Krumwiede

Co-Founder & Chief Marketing Officer

Colleen MacDonald Krumwiede is a financial aid and paying for college expert with over a decade of financial aid experience at Stanford GSB, Caltech, and Pomona College and another decade at educational finance and technology companies servicing higher education. She guides go-to-market strategy and product development at Quatromoney to transform the way families afford college.

Share

Recent Posts

Quatromoney

Quatromoney

276 Bridge Street

Springfield, MA 01103

Stay Informed with

The Good Math Blog

You need a helping hand with your project?

Thank you for subscribing to the Good Math Blog. We will send periodic emails with the latest posts.

With appreciation,

The Team at Quatromoney

Oops, there was an error sending your message.

Please try again later.

The Team at Quatromoney

All Rights Reserved | Quatromoney